In 2026, financial businesses across Canada will prioritise customer trust and fraud prevention systems as financial fraud is rapidly increasing. Evolving regulatory compliance is also a challenge for every Canadian financial business. KYC solutions play a massive role in ensuring legitimate identities and building confidence for new investors, vendors and business clients. A fraud-free business reputation in the competitive market matters a lot, and KYC checks assist in maintaining it for Canadian businesses. In this scenario, KYC companies in Canada assist financial businesses to ensure Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) regulations during the customer onboarding process.

But selecting a trusted and reliable KYC company is also a complicated thing for every Canadian business owner in the digital age, as various KYC service providers are available in the market. And to succeed in today’s competitive financial sector, choosing the top KYC providers in Canada is a strategic move to combat money laundering, synthetic identity fraud, and mitigate the risk of deepfakes.

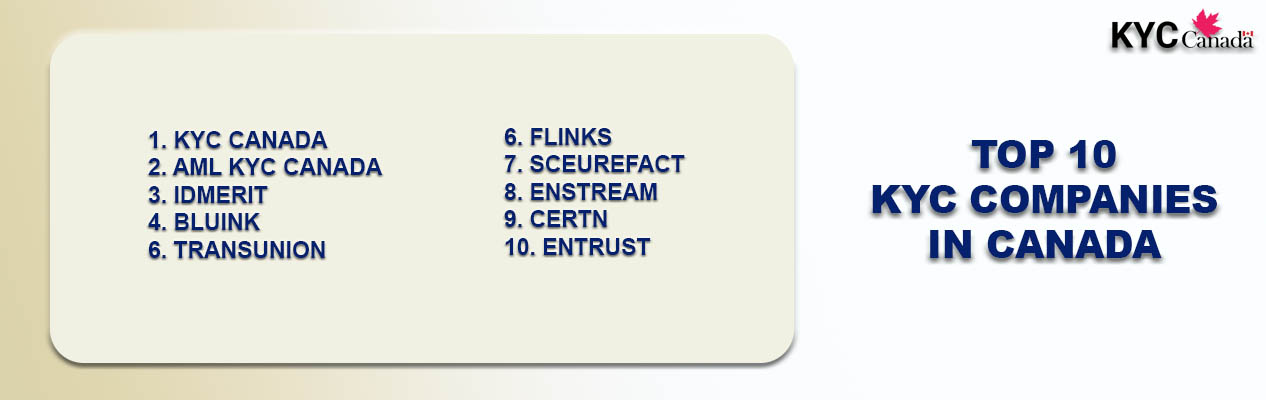

Best KYC Providers in Canada for 2026:

1. KYC Canada: The Regional Specialists

KYC Canada is one of the renowned name in the identity verification industry of Canada that provides AI and machine learning algorithm technology based KYC solutions for banks, financial institutions, fintech firms, insurance companies, cryptocurrency platforms, forex platforms, neobanks, payment processors, BNPL services providers, lending companies, healthcare companies, online gaming, and others non-financial businesses to stay compliant according to the Canadian laws and regulations. KYC Canada offers a full suite of identity verification, including KYC verification, video KYC verification, AML verification, document verification, age verification, business verification, PEP and sanction list verification.

Why Do They Lead the Canadian Market?

Canada-Based Company:

KYC Canada is a Canadian KYC company that is fully aware of local laws and regulations to authenticate the identity of the clients accordingly for small, medium and large-sized businesses.

Well-versed with Canadian Compliance:

KYC Canada is well-versed with Canadian regulations and keeps compliant financial and non-financial businesses according to the regulatory standard. They keep updating their KYC API with the latest regulations that also assist in preventing regulatory fines for non-compliance.

Advanced Identity Verification:

Using advanced technology along with features such as facial recognition, liveness detection, and OCR document scanning, KYC Canada helps organisations authenticate individuals with high accuracy, reducing risk and fraud.

Complete Solutions:

They offer complete identity verification solutions, including KYC verification, video KYC, AML verification, document verification, age verification, business verification, PEP and sanction list verification.

API Integrations:

Their API is easy to use and integrate with any platform, ERP and software.

Customised Solutions for Financial Businesses:

Provides a customised identity verification solution according to the financial business client’s needs.

Customer Support: Offers 24*7 customer support to resolve the client’s issues while using the API.

With its strong local focus, compliance expertise, and advanced technology, KYC Canada is a top KYC solutions provider among the top 10 KYC companies in Canada.

2. AML KYC Canada: Canadian KYC Provider

AML KYC Canada is a Canadian compliance solution provider focused on delivering AML and KYC solutions for businesses, whether it be a small, medium or large-sized. They also provide complete identity verification solutions, but AML KYC Canada is not a renowned name compared to KYC Canada. Their services are designed to help organisations comply with Canadian regulatory requirements, prevent fraud, and facilitate frictionless customer onboarding processes.

Why Select AML KYC Canada?

API-Based Platform:

AML KYC Canada is API API-based KYC provider that allows businesses to integrate KYC and AML checks directly into their systems and streamlining the onboarding process for companies.

Compliance Expert:

They are compliance experts, and their API identifies and verifies the identity of the customers quickly and securely.

Data Protection:

They also adhere to a data protection policy and process data on highly secured Secure Socket Layer networks in an encrypted format.

Cutting-edge Technology:

Offers cutting-edge technology-based identity verification solutions.

With local compliance expertise, AML KYC Canada is the second preferred choice among the best 10 KYC providers in Canada.

3. IDMERIT: Best for Global KYC Solutions

IDMERIT is one of the best KYC providers in the world in the current scenario and provides comprehensive identity verification solutions for banks, neobanks, financial institutions, insurance, payment processors, forex, fintech, cryptocurrency, BNPL companies, financial services companies, online gaming, real estate, education, telcom, Healthcare, border security custom, age restricted businesses, sharing economy businesses, automotive business and others. As a global KYC company, they provide comprehensive solutions to authenticate the identity of the customer within seconds, and they are even known for their highest matching rates in the identity verification industry.

Why IDMERIT?

Massive Data Coverage: IDMERIT has access to over 440 data sources across 180 countries to authenticate the identity of the client within seconds.

KYX Platform:

IDMERIT provides the IDMkyx platform allows multiple identity verification solutions on a single platform, like IDMkyc for KYC solution, IDMaml for AML solution, IDMscan for ID verification solution, IDMkyb for business verification solutions, IDMlive for video KYC solution, IDMsocial for social media profile verification, IDMconnect for utility bills verification and IDMtrust for individual risk score evaluations.

Multiple ID types:

Their API is capable of authenticating 580+ types of IDs globally.

Multilingual Support:

Their APIs support multiple languages, which allows customers to verify their identity in their native language.

Certification:

They are GDPR, HIPAA, and CCPA compliant and adhere to ISO 27001 and SOC2 requirements.

With massive global coverage, IDMERIT provides comprehensive identity verification solutions for the Canadian market.

4. Bluink: Canadian Digital Identity for Small and Medium Enterprises

Bluink is a Canadian digital identity verification solution provider that helps organisations comply with FINTRAC KYC requirements quickly. They are also a good contender among the best KYC providers in Canada, but they are particularly suited for small to medium enterprises.

Key Features:

Quick identity Verification:

Captures selfie and ID card scans for instant identity validation.

Familiar with Canadian Regulations:

As a Canadian identity verification provider, they are familiar with Canadian KYC compliance and authenticate the identity of the customer according to industries: They provide KYC solutions for financial services, Healthcare, legal and e-commerce services, the e-commerce, travel, and sharing economy industries.

For financial institutions that need a local compliance solutions provider can choose the Bluink platform as a KYC partner.

5. TransUnion Canada: Data-Driven Identity Verification Provider

TransUnion Canada is one of the country’s leading credit and identity data providers that assist in data-driven identity verification for financial businesses in Canada.

They are known for credit scores, but their identity verification services play a significant role in ensuring Canadian compliance.

Why TransUnion Matters?

Extensive Data:

With massive credit files and identity data, they verify the identity of the customer quickly and assist in customer onboarding.

Regulatory Support:

They assist financial businesses to support in regulatory compliance and ensure compliance to operate in the Canadian market.

With massive data availability, TransUnion assists in quick identity verification and ensures regulatory compliance.

6. Flinks: Data-Driven KYC

Flinks has headquarters in Montreal and is backed by the National Bank of Canada, which assists in KYC verification based on data. In 2026, KYC built trust by ensuring genuine business customers.

Advantages:

Account Ownership Verification:

They have a direct connection to 15,000+ financial institutions to confirm account details instantly.

Fraud Signals:

Real-time monitoring identifies suspicious account activity and gives a fraud signal to take action against it.

With data-driven KYC solutions, financial businesses can prevent fraud and secure their business.

7. Securefact: Canadian KYC Compliance Solution

Securefact offers KYC compliance solutions that ensure Canadian regulatory compliance for banking and non-banking businesses to operate smoothly. That’s why their name is considered among the top KYC providers in Canada.

Why Securefact?

Canadian Regulations-Focused:

Their KYC API is Canadian regulation-focused, which helps businesses to comply with FINTRAC and OSFI compliance.

Quick Onboarding:

They help financial institutions and banks in quick identity verification without face-to-face interaction.

Automation:

Simplifies manual compliance tasks with automated workflows.

8. Enstream: Canadian Identity Verification via Mobile Platforms

Enstream is a Canada-based KYC company that provides KYC solutions for Canadian banks, fintech and insurance companies.

Why Enstream?

Frictionless Onboarding:

Their API provides a frictionless customer experience by ensuring identity within seconds on mobile.

Local Canadian Entity:

As the Canadian identity verification provider, and assist in local compliance strategies to stay compliant.

Data Sources:

Direct access to all data from secure telco networks.

9. Certn: Easiest Background Check

Certn is a background check company in Canada that performs KYC checks to ensure genuine identities. They provide identity verification solutions that assist businesses in quick identity verification and speed up customer onboarding.

Why Certn?

Fictionless Onboarding:

They are specialized in frictionless KYC checks and allow all types of businesses to authenticate users and their background.

Risk Evaluation:

Their API quickly identifies fraudsters that use forged ID documents or synthetic identities and assists in evaluating the risk during the customer onboarding.

Preferred Partner:

They are a preferred partner for fintech platforms.

10. Entrust: AI Identity Verification for Canadian Financial Firms

Entrust is known for AI-powered identity verification solutions that assist financial businesses in meeting FINTRAC standards.

What do they offer?

FinTech Friendly:

Helps digital banks and fintechs automate compliance checks.

Robust Security:

Assist in building a strong security system that allows legitimate users to access the sensitive information.

AI Solution:

Provides AI-powered identity verification solutions for enabling smooth onboarding.

These top 10 KYC companies in Canada provide KYC solutions to quickly authenticate customers for small, medium, and large-sized businesses.

Secure Businesses in 2026 by Choosing the top KYC provider:

In 2026, secure business operations are the priority that builds customer trust, attracts investors, vendors, and new clients. The top KYC companies in Canada available in the market provide comprehensive identity verification solutions.

Select the KYC services provider that has:

- Advanced technology-based identity verification solutions, including features such as facial recognition and liveness detection.

- Support in multiple languages to provide a smooth customer experience.

- Provides 24*7 customer support to resolve the client’s technical issues.

- Have global reach to support expanded businesses globally.

- Have multiple identity verification methods for thorough background checks.

- Provides a demo of their API to understand the functionality and reporting.

- Fully familiar with Canadian local regulations and even international compliance to operate globally.

- Assist in scaling the business growth if the company or organisations expand their business.

- Highest matching rates for a quick onboarding process.

- API should have the flexibility to integrate with any existing system.

Whether you choose KYC Canada, AML KYC Canada, IDMERIT, Bluink, TransUnion Canada, or any other top 10 KYC providers, prioritise the advanced technology that keeps ahead of the curve in the competitive market of Canada and safeguards financial businesses from advanced threats. By integrating an advanced KYC API, ensure Canadian compliance, maintain a fraud-proof business reputation and build a strong client relationship for long-term business growth.